If you’ve ever considered investing in gold but weren’t sure where to start, look no further! In “The Ultimate Guide to Gold investment with Maybank,” we’ve got you covered. This comprehensive article will provide you with all the information you need to know about gold investment, including step-by-step instructions, expert tips, and insights from Maybank, a leading financial institution. Whether you’re a beginner or an experienced investor, this guide will help you navigate the world of gold investment and make informed decisions. So, grab a cup of coffee, sit back, and get ready to embark on your journey to financial prosperity with gold investment. Pelaburan Emas

Why Invest in Gold?

Gold investment is a popular choice for many investors seeking stability, security, and potential returns. With its long history of value and appreciation, gold has been a trusted asset for centuries. In this comprehensive guide, we will explore the benefits and intricacies of gold investment with Maybank.

Understanding Gold Investment

What is Gold Investment?

Gold investment involves buying and holding physical gold or investing in financial instruments tied to gold’s value. This can include gold coins, bars, jewelry, or gold-backed exchange-traded funds (ETFs) and funds. Gold is recognized as a globally accepted form of currency and a store of value.

what are the best sources for buying gold in Malaysia?

How Does Gold Investment In Malaysia Compare To International Markets

Are There Any Malaysian Gold Investment Apps Or Platforms

Why Choose Gold Investment?

There are several reasons why investors choose gold as an investment:

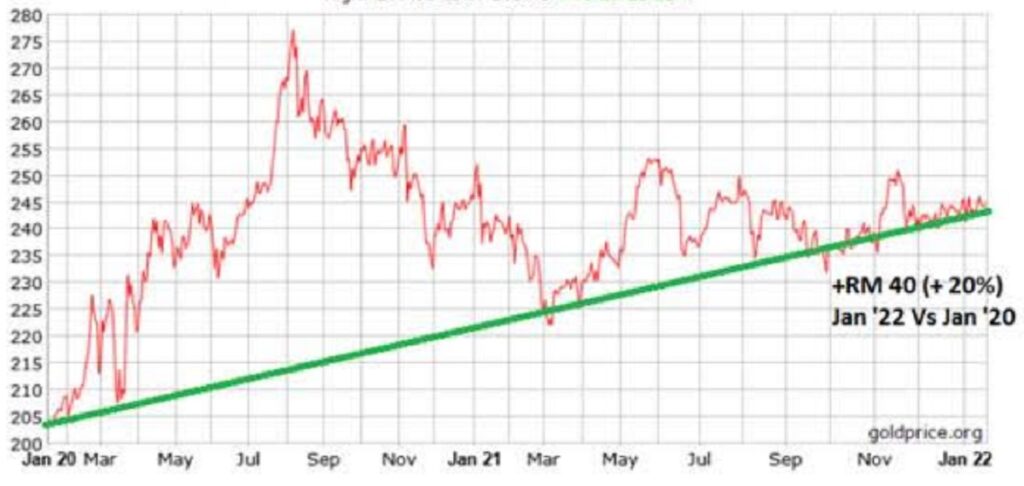

- Preservation of Wealth: Gold has maintained its value over time and can act as a hedge against inflation and economic uncertainties.

- Diversification: Investing in gold can help diversify your investment portfolio, reducing risk and volatility.

- Global Demand: Gold has universal appeal and is in demand worldwide, providing liquidity and market stability.

- Potential Returns: Over the years, gold has shown the potential for positive long-term returns, especially during times of economic crisis.

Types of Gold Investments

When considering gold investment, it’s essential to understand the different options available:

- Physical Gold: Purchasing physical gold in the form of coins or bars allows you to own the tangible asset directly.

- Gold Jewelry: Owning gold jewelry not only serves as a form of personal adornment but also as an investment.

- Gold ETFs and Funds: These financial instruments are designed to track the price of gold without the need to physically own it.

- Gold Mining Stocks: Investing in mining companies that extract gold can provide exposure to the industry.

How Does Gold Investment Work with Maybank?

Maybank offers a comprehensive platform for gold investment, allowing investors to buy, sell, and store their precious metal securely. With Maybank’s expertise and access to global markets, you can navigate the world of gold investment with ease.

Opening an Account with Maybank

Step 1: Research and Compare

Before opening a gold investment account with Maybank, it is recommended to research and compare different investment options. Consider factors such as fees, minimum investment requirements, and storage facilities.

Step 2: Visit Maybank Branch

Visit a nearby Maybank branch to start the account opening process. Speak to a representative who will guide you through the necessary steps and provide additional information about their gold investment offerings.

Step 3: Provide Required Documents

To open a gold investment account with Maybank, you will need to provide the following documents:

- Identification: A valid passport or government-issued ID card.

- Proof of Address: A utility bill or bank statement with your address.

- Additional Documentation: Maybank may require additional documents to comply with regulatory requirements.

Step 4: Complete Account Opening Process

Once you have provided the necessary documents, Maybank will guide you through the account opening process. They will assist you in filling out the required forms and ensure that you have a clear understanding of the terms and conditions associated with your gold investment account.

Funding Your Gold Investment Account

Methods of Fund Transfer

Maybank offers various methods for funding your gold investment account, including electronic fund transfers, check deposits, and cash deposits at selected branches. Choose the most convenient method for you and follow the provided instructions.

Minimum Account Balance

Maybank may require a minimum account balance to open and maintain a gold investment account. Ensure you have sufficient funds to meet this requirement before proceeding with your investment.

Tracking Your Funds

Once you have funded your gold investment account, Maybank provides tools and platforms to easily track the performance and balance of your investment. Utilize these resources to stay informed about your investment’s value and make informed decisions.

Monitoring Your Gold Investment

Using Maybank’s Online Platform

Maybank’s online platform allows you to monitor your gold investment conveniently. Access your account securely and view real-time updates on gold prices, account balances, and transaction history.

Real-time Gold Price Updates

Stay on top of gold price fluctuations with Maybank’s real-time gold price updates. This feature ensures that you have the most up-to-date information to make timely investment decisions.

Account Statement and Transaction History

Maybank provides regular account statements and transaction history, allowing you to review your gold investment activity thoroughly. These statements serve as documentation for tax purposes and help you keep track of your investment performance.

Managing Your Gold Investment

Diversifying Your Portfolio

While gold investment offers stability and security, it’s important to diversify your portfolio to spread risk and potentially increase returns. Consider investing in other asset classes, such as stocks, bonds, or real estate, to achieve a well-rounded investment strategy.

Managing Risk

As with any investment, gold investment carries its own risks. Stay informed about global economic and geopolitical events that may impact gold prices. Be prepared to adjust your investment strategy if necessary.

Rebalancing Your Gold Holdings

Regularly review your gold holdings to rebalance your investment portfolio. If the price of gold has risen significantly, consider selling a portion of your holdings to maintain an appropriate asset allocation. Conversely, if the price has fallen, you may choose to increase your holdings.

Selling Your Gold Investment

Understanding the Selling Process

At some point, you may decide to sell your gold investment. Maybank provides a straightforward selling process, allowing you to convert your gold holdings back into cash. Contact Maybank for specific instructions and guidance on selling your gold investment.

Withdrawal and Transfer Options

Maybank offers various options for withdrawing or transferring the proceeds from your gold investment. These options may include bank transfers, cashier’s checks, or physical gold delivery, depending on your preferences and account terms.

Taxation on Gold Investment

Consult with a tax advisor to understand the tax implications of selling your gold investment. Tax laws may vary by jurisdiction, and it’s essential to comply with all applicable regulations.

Benefits of Gold Investment with Maybank

Professional Guidance and Support

Maybank provides professional guidance and support throughout the entire gold investment process. Their experienced staff can answer your questions, provide market insights, and help you make informed investment decisions.

Secure Storage and Insurance

Maybank ensures the secure storage of your physical gold holdings. Their facilities are designed to protect your investment against theft, damage, or loss. Additionally, Maybank provides insurance coverage, providing you with peace of mind.

Access to Exclusive Gold Products

Maybank offers access to exclusive gold products, including limited edition coins and commemorative pieces. These unique offerings can add value to your investment portfolio and serve as cherished collectibles.

Frequently Asked Questions

How to Calculate the Value of Gold?

The value of gold can be calculated by multiplying the weight of your gold holdings by the current market price of gold per ounce. This calculation provides an approximate value, excluding any premiums or fees.

Can I Invest in Gold without Physical Ownership?

Yes, you can invest in gold without physical ownership through gold-backed financial instruments like ETFs and funds. These instruments track the price of gold and allow you to gain exposure to the precious metal market.

Can I Transfer my Gold Holdings to Another Bank?

Transferring gold holdings to another bank may be possible, depending on the bank’s policies and procedures. Contact Maybank to inquire about the transfer process and any associated fees or requirements.

What Happens to My Gold Investment if Maybank Closes?

In the unlikely event of Maybank’s closure or bankruptcy, your gold investment should still be safeguarded. Maybank’s secure storage facilities ensure the physical integrity of your gold holdings, and the relevant regulatory bodies will intervene to protect your investment.

What Happens if I Forget my Account Login Information?

If you forget your account login information, contact Maybank’s customer service for assistance. They will guide you through the account recovery process and help you regain access to your gold investment account.

In conclusion, gold investment with Maybank offers numerous benefits, including stability, diversification, and potential returns. By following the account opening process, funding your account, and effectively managing your investment, you can navigate the world of gold investment with confidence and maximize your investment’s potential. Maybank’s expertise, secure storage, and exclusive gold products further enhance the overall gold investment experience. Take advantage of this timeless asset and start your gold investment journey with Maybank today.